Balance

The prioritization process can sometimes result in a skewed portfolio. Whether it is single-criteria analysis of multi-criteria analysis, there is a possibility of too many projects of the same type getting approved. For example, in a production organization, any project that has the capability of increasing sales by 10%, fits to existing marketing strategy, requires very little R&D and fits to existing supply chain, can easily go through and get a good score. If there are ten such projects, all of them can get prioritized, starving other initiatives. And the end result will be ten product launches for the company at the same time! This is the result of an unbalanced portfolio.

This practice is part of the portfolio definition cycle.

Purpose

Portfolio balancing aims to overcome this problem by organizing the projects and programmes in a way that initiatives give optimal output for the business. This will also prevent a lot of projects finishing at the same time or some resources getting overwhelmed. Balancing helps to achieve all organizational strategic goals and maintains the organizational risk at a reasonable level, by preventing too many high-risk projects or too many low-risk projects getting executed.

Portfolio balancing must always take place after prioritization.

Implementation

Portfolio balancing can be done manually using a set of independent criteria from what was already selected for prioritization. It can also be done qualitatively, by portfolio governance body assessing the whole portfolio to find out whether any imbalance is created. Large organizations may choose algorithmic assessments to balance the portfolio.

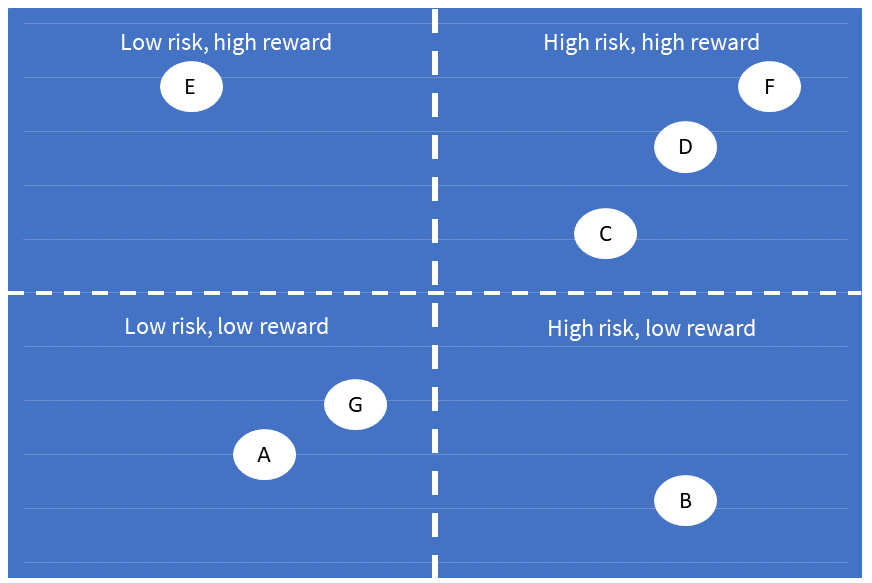

Graphical representation of the projects and programmes in the portfolio is always helpful for understanding the current nature of the portfolio. Following is an example that shows how the prioritized projects in the portfolio, match two balancing criteria (risk and reward).

This example shows three high-risk, high-reward projects, two low-risk, low-reward projects, and one each for low-risk, high-reward and high-risk, low-reward. From the outset, the portfolio governance team can choose to cancel the high-risk, low-reward project, because it would not make a sensible investment. If three projects are too many for high-risk, high-reward criteria, then the organization can opt for removing one of them or moving it to a different timeline.

Deliverables

A balanced portfolio in terms of the chosen balancing criteria will be the result of the “Balance” practice. Good practices of portfolio-balancing include representation of information in a graphical format, portfolio governance committee involvement and the usage of objective techniques such as algorithms to carry out balancing. No one (especially the management) should be allowed to overrule the results of the balancing process and it is always preferable for the portfolio office to sign-off on it.

Written by Inham Hassen

This wiki is developed and managed by an accredited trainer, independent of AXELOS. While aligned with their guidelines, it’s not an official resource.